Interactive Price Chart

The 2nd “Most Consumed” Commodity in the World

Since the dawn of time silver has been used as a means of exchange. It will never become worthless. It requires little to no maintenance and most importantly – physical silver is inconspicuous and liquid.

» Understanding Precious Metals Pricing

Silver is in the stages of a long over-due price explosion. The power of silver as an investment can not be overstated. It doesn’t really matter whether you choose to invest in gold or silver. It depends more upon what you can afford to invest. There is something very powerful about connecting with the actual metal.

Buying is QUICK & EASY

Step 1: Call to order (888) 747-3309

Step 2: Make a one-time purchase or recurring monthly order.

Step 3: Have your gold or silver stored or take physical delivery.

As a Cornerstone customer you may have your metals stored on behalf at an independent depository with a Certificate of Deposit issued directly to you, or take personal delivery at any time.

The History of Silver Coins

The history of silver shows that, like gold, it is money. The big difference is that while silver is money, it is also an industrial metal. Did you know that in over 14 languages the word for ‘silver’ and ‘money’ are the same? You’ve heard of the gold standard, but it actually replaced the silver standard in the 1800’s. Unlike gold, whereas most of the mined stock is still in existence, most of the mined silver has been used up and is in relatively short supply.

In 2006 39.8 million ounces were produced as silver coins.

Silver has been used as money as far back as 550 B.C. and continues to be used to this day in some countries including Mexico.

Since Silver was more plentiful and of less value than Gold it served as a practical means of exchange. Today most of the silver produced is consumed in one form or another with only 64 million ounces per year set aside for investment purposes.

» Learn about Cornerstone Crowns

With such a small amount of produced silver actually making it to market, the price of silver will see some spectacular gains when even a relatively small amount of silver is sought for investment.

The reason is because new uses for silver are being invented and applied every day. The superior properties of silver have been apparent in many applications for many years while new technologies are discovering silver’s superior qualities.

Supply and Demand for Silver

The long bear market for gold and silver investing has led to a lack of investment in discovering new silver mines worldwide and now that investment and industrial uses for silver is skyrocketing the spot price has had no choice but to steadily rise.

In 2006 the supply and demand of silver matched at 911.8 million ounces. As demand increases for both investment and industrial application this figure will become skewed, needing more supply to meet the demand needs. The only remedy for this will be higher prices.

Exploration for silver is definitely picking up but it takes from seven to ten years to bring a mine on stream. Exploration was at just $2 billion worldwide in 2002 and picked up steadily to over $5 billion in 2005. These figures are just a small portion of the total worldwide exploration budget being spent this year. Many new companies are beginning to explore as they see this as a new frontier with a long and sustainable life.

Recently the physical silver and paper (futures) prices have begun to diverge. While futures contracts can be manipulated without any actual silver changing hands, the physical market cannot. Demand for silver investment has recently picked up pace and there are stories of lack of physical silver from dealers throughout the world.

This divergence will continue and retail investment in silver will become increasingly difficult to obtain. In my and many experts’ opinions, silver will at some point in the near future exceed its intraday COMEX all–time high of $50.35 by the time this bull market nears its end.

Buying is QUICK & EASY

Step 1: Call to order (888) 747-3309

Step 2: Make a one-time purchase or recurring monthly order.

Step 3: Have your gold or silver stored or take physical delivery.

As a Cornerstone customer you may have your metals stored on behalf at an independent depository with a Certificate of Deposit issued directly to you, or take personal delivery at any time.

Physical silver has no counter-party risk. Simply put – if you hold it, you own it! The same cannot be said for paper assets like stocks, bonds, and mutual funds. When invested in paper assets, the holder always assumes the risk of the counter-party’s solvency. This is not an issue with physical silver.

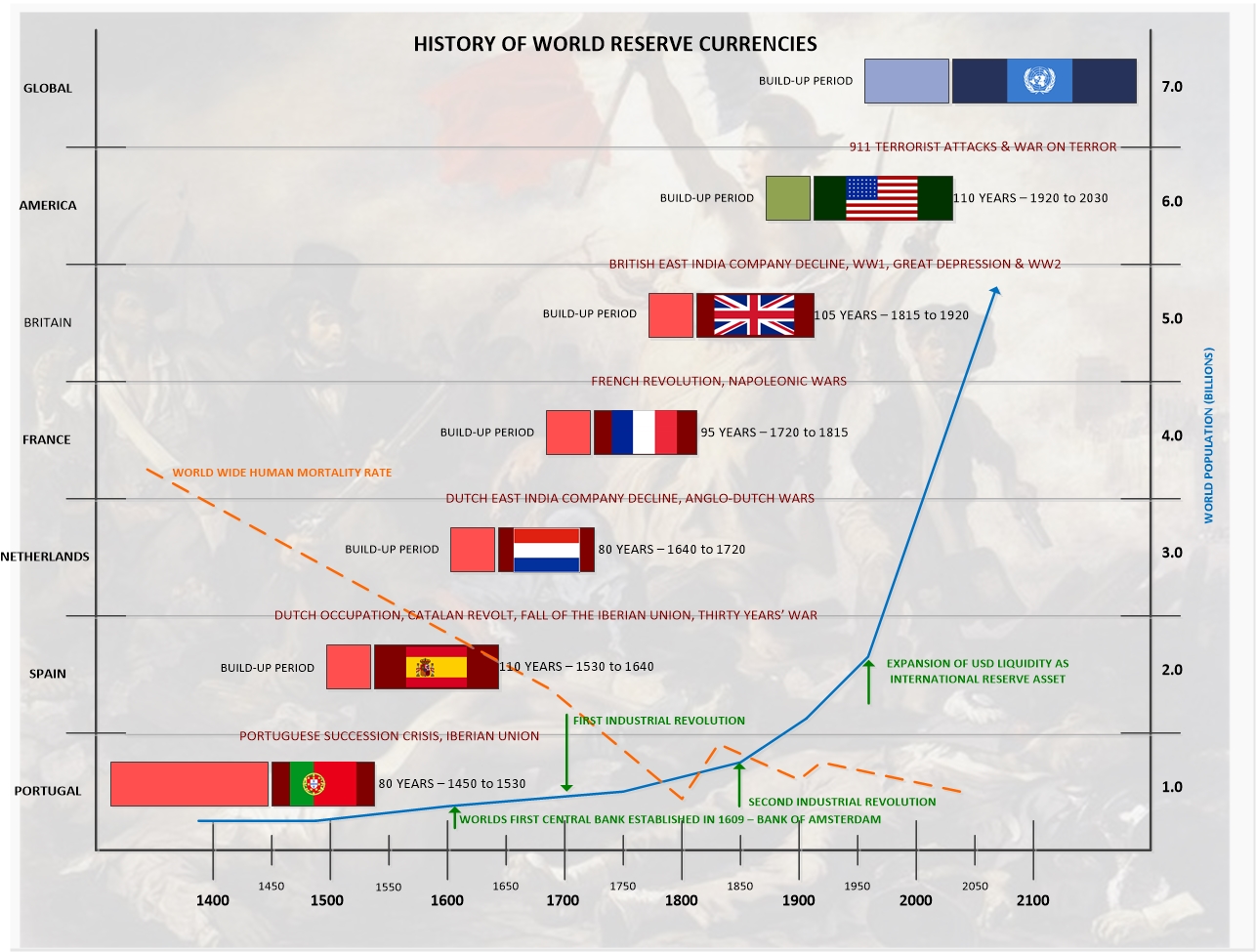

For the first time in the history of the world, all the currencies are fiat.

You have two primary choices in your investing strategy:

- Invest in precious metals: That is, silver and gold investments which are real money and a tangible asset of stored value.

- Investing in fiat: That is, paper currencies and paper-backed investments which can be considered IOU’s and may waver in times of volatility.

From Our Founder & Chief Strategist

We look forward to placing you back in charge of your wealth in order to lead a life with meaning and purpose.

Terry Sacka, AAMS